Service, Quality & Solution

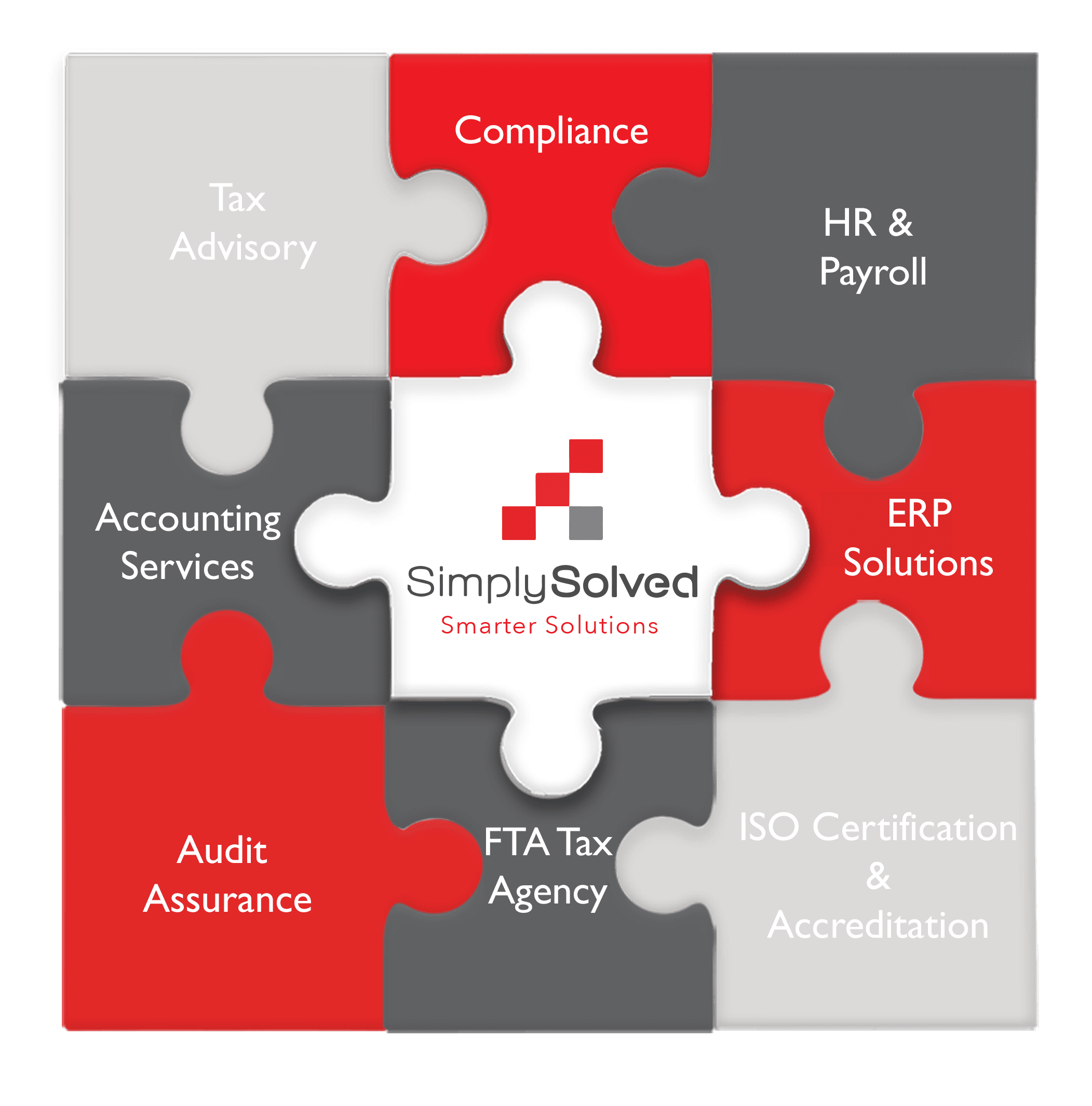

SimplySolved delivers ISO 9001, 27001 & 42001 quality advisory, project, and services in Outsourced Accounting, VAT Registration, Corporate Tax, Employee Management & Payroll and ERP & Zoho Implementation Services.

OUR SERVICES

Accounting & Tax

Cost affective compliant outsource Accounting & Tax awareness with FTA cerified full functionality platform

Corporate Tax & Tax Agency

Corporate Tax & Tax advisory services and FTA Tax Agency procedural assistance support

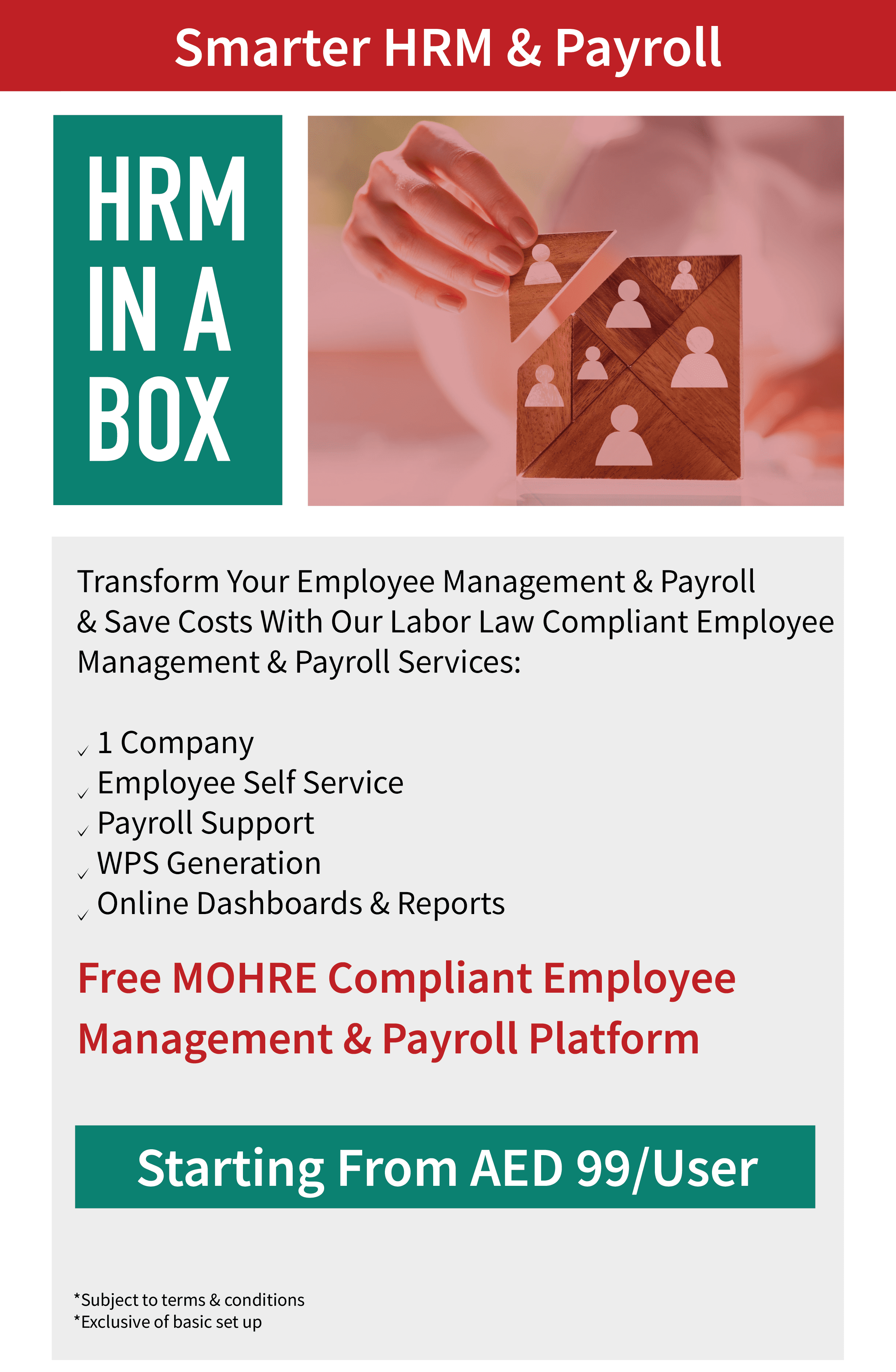

Employee Management & Payroll

HR advisory and outsource Employee Management & Payroll services with free UAE compliant platform

ERP & Zoho Implementation

Consulting implementation and training services to deliver increased operational efficiency and reporting or integrate E-Commerce Solutions

Promotional Offers

As an ISO 9001, 27001 & 42001 certified & FTA Tax Agency, our service packages comply with UAE Tax Legislative and FTA requirements with best practices and a free software platform.

AWARDS & CERTIFICATION

Continuous Quality. Continuous Excellence. Consistently Delivered.

Why Work With Us?

At SimplySolved, we save your time, resources, and costs. Whether you need help with Outsourced Accounting, VAT Registration, Corporate Tax, Employee Management & Payroll, or ERP & Zoho Implementation Services. we have the expertise and solutions to help.

We have worked with 100’s satisfied clients across all industries. Contact us and see how we can help your business deliver superior results and save costs.

Join our 100’s of satisfied clients across all industry segments who trust us to understand their issues, implement best practice quality services with minimal disruption and improve their performance and compliance

Don’t let the complications of running your internal Back Office processes burden you any longer.

Inefficient internal operations make it hard to run your business. SimplySolved helps you optimise your tasks. We offer a range of services and solutions enriched with best practices.

OUR CLIENTS

OUR SERVICES ARE TRUSTED BY 100’s OF COMPANIES

UAE Corporate Tax & Free Zone Companies

If your business is assessing the impacts and strategy to manage your Corporate Tax obligations and effectiveness, our consultants can assist you in planning and implementing your Corporate Tax and transfer pricing model.

FAQs

What Is Required Under The UAE Legislation?

Your business must comply to the Tax Legislation which includes mandatory registration for Corporate Tax and VAT if you exceed the income threshold of AED375,00. In addition, you must maintain a set of accounts, submit and pay dues taxes by the required deadlines.

What Is Needed To Manage Your Obligations?

Legally you must maintain a proper set of accounts and details supporting your tax calculations including supporting accounting documents. Your Taxes should meet the eligible rules and not breach any published requirements.

Tax filings and payments must be made on time depending on your required reporting periods.

How Do We Help Our Clients?

The right support can make a difference to your business. We focus on making the complicated simple with an all encompassing solution. This includes an FTA certified accounting platform, accounting/tax expertise and guidance to meet all your accounting and tax needs under an affordable monthly fee.

Whether you are a start up or a large medium size enterprise, we have the experience and solutions to support your business.

How Do We Optimise/Improve Your Accounting & Tax Obligations?

We take time to understand your business and how you work. The Laws can apply differently depending on your business transactions. Advice and guidance are essential to set the right course to minimise risks and tax liabilities.

Every step from setting up our service to ongoing management continually assesses and provides specific guidance for efficiency and tax optimisation. This is fully systemised and managed under our ISO 9001 & 27001 certified standards.

Why Is This A Complete Solution For Businesses?

Everything you require to implement a scalable financial and tax reporting model is included in our service packages: Best in class platform, FTA Tax Agency accounting and tax expertise and ISO quality procedures.

Systemising your accounts and reporting is the best option to set a solid foundation to run your business. Our service is designed to grow with your business and we update you on any changes to the Legislation affecting your business.

How Can This Save You Costs?

Our service is upto 60% lower than an internally managed option. As partner to 100’s of businesses, we have provided operational continuity saving disruptions from staff mobility with no need for staff salaries or visa costs. In addition, we diligently manage changes from the Legislation and minimise compliance risks that could lead to penalties.

How Do We Deliver Reliably & Effectively?

We operate to ISO 9001 & 27001 standards for quality and information security. This ensures our services are delivered to set standards and underpinned by our service delivery mobile and desktop application which provides transparency and control to ensure every necessary step is followed and monitored.

We operate in teams and each client has an appointed person who knows your business supported by a wider team accessible for any complex requirements or support. Your engagement is fully controlled and all documents and interactions are auditable in case of government or tax authority query.

We have invested in our service delivery to simplify the complex and take the burden from your business while providing transparency and service level assurance.

How Can We Help Your Business Grow?

Allowing us to manage the financial and tax processes provides you time to focus on growing your business. We take care in implementing reliable financial and tax management, a best in class platform and addressing any questions. Our dedicated AM can also provide financial insights to target issues for management attention.

In addition, we have expertise across a wide range of business needs including advisory, audits, HR & Payroll, compliance, ERP systems and ISO certification. Our clients view us as a trusted partner providing a one stop solution to operating and growing their UAE business.

How Soon Can You Benefit From Our Service?

Your business can start deriving value and benefits in a few days. Our initial advice and guidance will help clear any tax and non-compliance risks. In a couple of weeks, we can have you fully operational with a real time financial reporting model.

How Do We Price Our Service?

Our packages are priced for simplicity and ease of budgeting. Our scope is clear without hidden fees. We offer registration, software, guidance and management for your accounting and taxes for a simple monthly fee. We just need some information on the transactions and volumes to provide a fixed monthly fee.

CONTACT US

Whether you have an existing Accounting, VAT, Audit, Corporate Tax, Employee Management & Payroll and ERP & E-Commerce Integration function operating its own system & process, or a small or medium company needing complete outsourcing services, we have the flexibility to serve your business.

Mon - Fri: 9am - 6pm, Sat - Sun: Closed

Copyright © 2024 | SimplySolved | All Rights Reserved.