Economic Substance Regulation- May Update

May 19,2020 / Haroon Juma / Substance Reg Blogs

As a UAE registered entity, you will be affected by the Economic Substance Regulations.

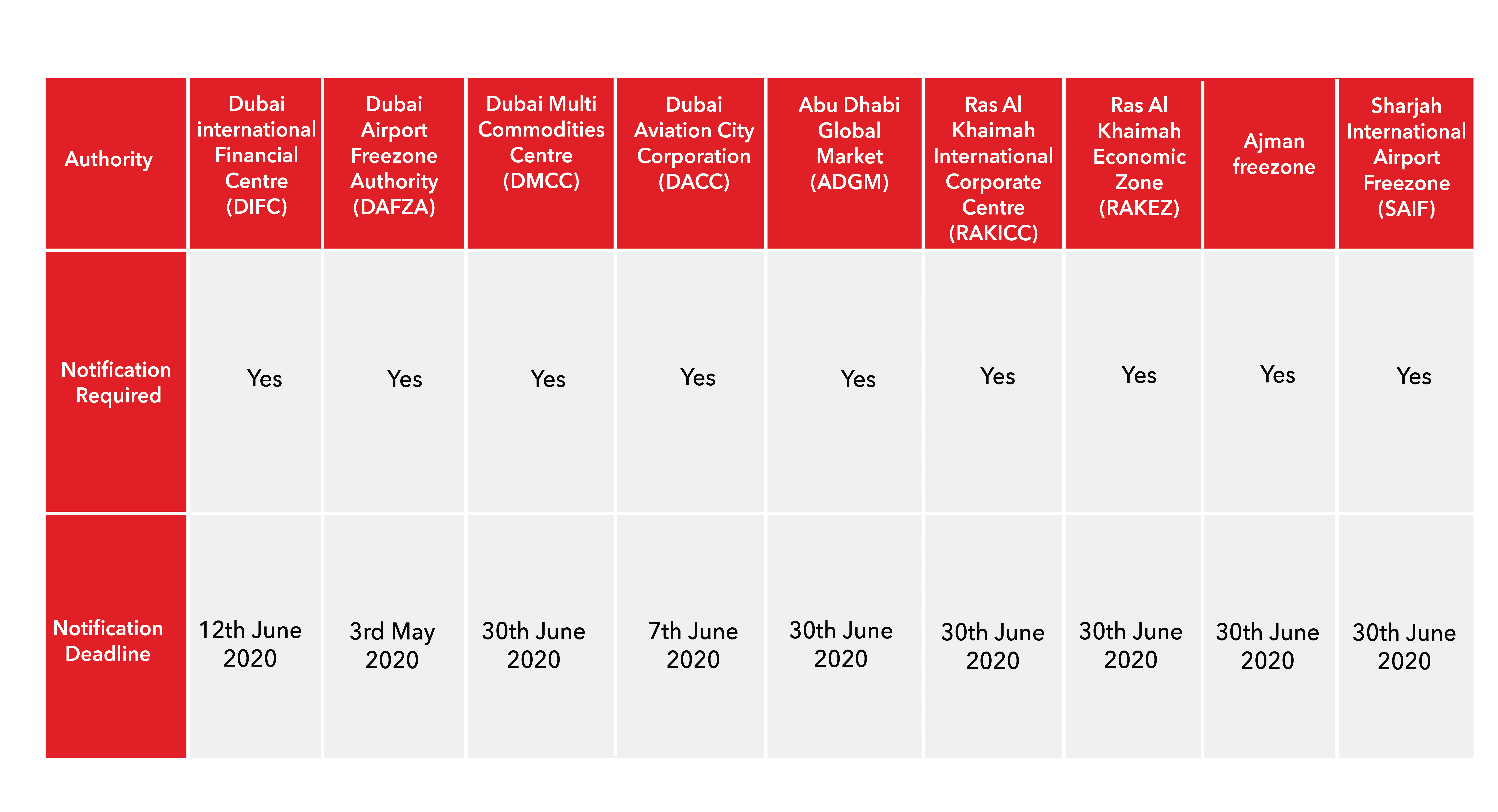

The first stage of the implementation will be to submit your notice before the deadline issued by the Ministry of Finance.

UAE Ministry of Finance (MOF) has issued the second edition of the Economic Substance Regulation (ESR). It describes the implications of ESR, they further issued Cabinet of Ministers Resolution No. 31 of 2019 Ministerial Decision No. 215 for the year 2019 providing additional guidance on ESR (‘additional guidance’), and Cabinet Resolution No. 58 of 2019 determining the Regulatory Authorities.

All Trade Licensing Authorities will duly announce their compliance process. The first tranche is announced, and other jurisdictions will follow in due course.

How do you determine whether you are eligible for the ESR?

How do you determine whether you are eligible for the ESR?

Establishing whether your business is subject to the ESR Legislation and providing accurate information in your notification submission will be the first requirement.

Authority |

Informational Guidelines |

| Dubai International Fin. Centre (DIFC) | DIFC Entities are required to submit ESR notification even if the entity conducts a relevant activity or not. Are you eligible ? |

| Dubai Airport Freezone Authority (DAFZA | All DAFZA entities that carry out relevant activities. Are you eligible? |

| Dubai Multi Commodity Centre (DMCC) |

Applicable to all licenses that carry out a relevant activity. Are you eligible? For More information, Click |

| Dubai Aviation City Corporation (DACC) | Licensees to report whether they carry out relevant activities or not. Are you eligible to report? |

| Abu Dhabi Global Market (ADGM) | If you are a relevant entity, located in ADGM and financial year starts from or after 1 JAN 2019. You are eligible! |

| Ras Al Khaimah Economic Zone (RAKEZ) | Applicable to all licenses that carry out a relevant activity. Are you eligible? |

| Ras Al Khaimah International Corporate Centre (RAKICC) | Licensees to report whether they carry out relevant activities or not. Are you eligible? |

| Sharjah International Airport Freezone (SAIF) |

Applicable to all licenses that carry out a relevant activity. Are you eligible? For more, information. |

| Other Trade License Authorities | YET TO BE PUBLISHED. |

All jurisdictions should immediately file their ESR declaration to avoid penalties and fines imposed by the Ministry of Finance.

If your business requires assistance, our trained consultants can assess your eligibility and file your declaration. Please contact us to further assistance.

Talk to the US!

Call us at 043445338 or Visit us at www.simplysolved.ae

About SimplySolved

At SimplySolved, we save your time, resources, and costs. Whether you need help with Outsourced Accounting, Finance, Corporate Tax, Employee Management & Payroll and ERP & E-Commerce Integration. we have the expertise and solutions to help.

Subscribe to mailing list

Partner With SimplySolved

Serving over 300+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM & Payroll & ERP solutions. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the legislation and help you make better business decisions.

Copyright © 2024 | SimplySolved | All Rights Reserved.

How do you determine whether you are eligible for the ESR?

How do you determine whether you are eligible for the ESR?