Economic Substance – Compliance and Administrative Penalties

April 5th, 2021 / Haroon Juma / UAE Economic Substance Regulations

Annual Compliance and Key Actions

The Economic Substance Regulations (ESR) apply to all United Arab Emirates (UAE) onshore and free zone legal entities. It carries out one or more of the Relevant Activities (RA) referred to as “Licensees”.

Affected Licensees must comply with the following two annual filing requirements:

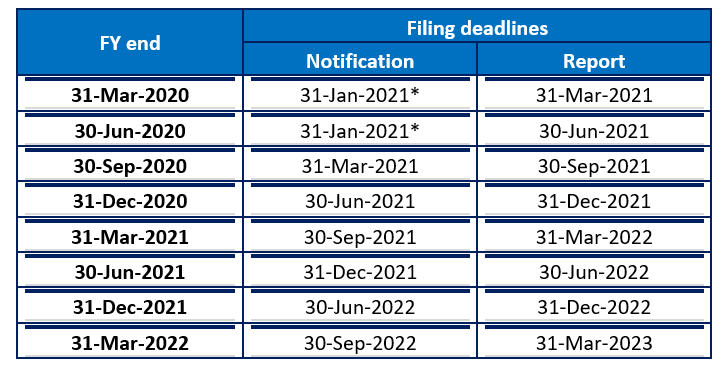

1. Notification: File a notification within 6 months, after the end of the relevant financial year (FY), irrespective of whether exempt from the ESR or income was earned from the RA.

2. Report: File a report within 12 months after the end of the relevant Financial year. If earning income from a RA during the Financial year and not exempt from the ESR.

Deadlines for a selection of Financial Year-End:

Economic Substance Regulation

*Extended deadline.

Financial and non-financial penalties may apply for non-compliance.

Key actions

1. All entities should determine their upcoming ESR filing obligations for any completed FY. It should also ensure that filings are made within the applicable deadlines.

2. To understand the exact compliance requirements for the period, an entity will first need to assess whether its activities fall within the scope of the ESR Relevant Activities.

3. Eligible Licensees who wish to claim one of the exemptions from the ESR, in their notification should gather any supporting documentation as evidence.

4. All supporting documents should be filed along with a copy translated into English (if not originally in English).

5. Licensees earning income from one or more RA should review their compliance with the applicable ESR tests (Directed and Managed, Core Income Generating and Adequacy).

Penalties for Non-Compliance and the Appeals Process

National Assessing Authority may issue administrative penalties to Licensees for non-compliance with the ESR.

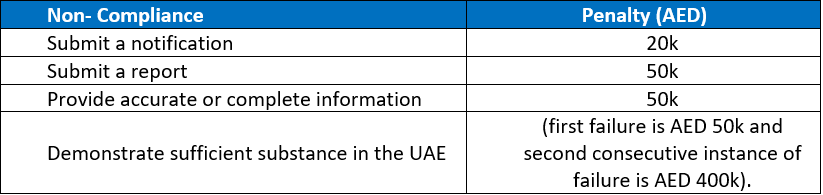

Penalties for non-compliance with the ESR are broad and significant. Financial penalties include the failure to:

Non-financial penalties may include the exchange of information with foreign authorities and suspension, revocation, or, non-renewal of the Licensee’s trade license.

It is recommended that Licensees understand when and how penalties are issued and the right to appeal against imposed penalties.

Significant financial & non-financial penalties for consecutive non-compliance persist and ensuring a compliant filing is essential to avoid such penalties.

It is recommended that under instances of non-compliance with the ESR, entities should take steps as quickly as possible to move the entity into a compliant position and prevent consecutive non-compliance.

There is evidence to date (aside from late filings) suggesting that the majority of non-compliant entities are in this position due to a lack of knowledge of the ESR within the business and limited or no internal governance procedures in place to ensure compliance with the new requirements.

Assistance To Ensure Compliance

If your entity requires validation and assistance to meet its ESR obligations and maintain a “clean record”, the SimplySolved team can support you with any of the following areas:

- Assessment of ESR Relevant Activities & obligations

- Compliance and reporting obligations and assistance

- Drafting responses to inquiries from the relevant UAE authorities

- Supporting the appeals process, and

- Advice concerning areas of non-compliance and actions to move the entity into a compliant position.

About SimplySolved

At SimplySolved, we save your time, resources, and costs. Whether you need help with Outsourced Accounting, Finance, Corporate Tax, Employee Management & Payroll and ERP & E-Commerce Integration. we have the expertise and solutions to help.

Subscribe to mailing list

Partner With SimplySolved

Serving over 300+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM & Payroll & ERP solutions. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the legislation and help you make better business decisions.

Copyright © 2024 | SimplySolved | All Rights Reserved.