UAE FTA Tax Audits – What Should You Expect?

April 28th, 2021 / Haroon Juma / VAT Blog

Your UAE VAT Returns form a legally binding statement of your UAE tax liabilities as a self-declared assessment, this means the preparation and accuracy are the responsibility of the taxable person.

As the UAE VAT system settles in the UAE, FTA Tax Audits are likely to increase. In this blog, we discuss the key questions that better answer the key questions surrounding an FTA Tax audit.

What Is A UAE Tax Audit?

Under the Organization for Economic Co-operation and Development (OECD) guidelines, an audit is defined as:

“Examination of whether the taxpayer has correctly assessed and reported their tax liability and fulfilled other obligations.”

Under a self-assessment system, audits are considered essential to promote voluntary compliance and:

• Identify non-compliance to the Legislation

• Gather intelligence on the state of the tax system.

• Gather supply chain information (an audit on any business could trigger an audit on another business)

• Educate businesses and assist in the implementation of the law and identify areas that require may require clarification.

The UAE Tax Authority will require access to accounting records, documentation, and personnel to conduct their audit.

Some Misconceptions

Your UAE business may have filed your UAE VAT Returns and in some cases received refunds without any audit procedure.

This does not necessarily mean the UAE FTA has accepted any non-tax audited business as compliant. They reserve the right to tax audit any business for up to 5 years, hence it should be your responsibility to remain compliant and proactive to any changes to the UAE VAT Legislation.

When & What Triggers A UAE Tax Audit?

A Tax Audit can be triggered by a variety of factors and may not be solely determined by the size of the business. The timing for any UAE Tax Audit cannot be predicted, nevertheless, several criteria most likely lead to an audit:

Criteria |

What Factors Increase Risk Of Audit? |

| System Generated |

The FTA system can flag a range of exceptions and anomalies. This could be based on: – Payment position and owed taxes – Comparison to peers in your sector – Variations across your returns |

| Type Of Business |

Examples include: Cash based businesses Businesses subject to customs and duty processes Businesses subject to refund claims such as exporters, healthcare and education |

| Supply Chain | If a customer or supplier has been subject to an audit |

| Size of Business | Volume of business and scale of operations |

| Public Referrals | Notification to the FTA by the public |

What Are The UAE Legislative Powers?

The UAE Legislation grants the FTA wide-ranging powers to ensure compliance is met. These powers (set out across six documents issued under the UAE VAT Legislation) grant the FTA powers to compel businesses to full disclosure and also subject penalties for non-compliance. In terms of the specific audit procedures, the law grants:

Legislation Reference |

Authority Granted |

|

Federal Decree-Law No. (13) of 2016 On the Establishment of the Federal Tax Authority

|

Inspect taxpayers’ records and documents Review tax returns and reports submitted to the FTA, audit them, decide on approving or amending the same, or request additional information or documents Demand access to any information or data available with any third party who may possess information about a person being subjected to a tax audit which may be necessary for the tax audit process Demand from any person having dealings with a person subject to a tax audit to provide information about such transactions |

| Cabinet Decision No. (36) of 2017 on the Executive Regulation of Federal Law No. (7) of 2017 on Tax Procedures |

Accounting records and commercial books including Accounting books, which include records of payments and receipts, purchases and sales, revenues and expenditures, and any business, and any matters as required under any tax law or any other applicable law, including: Balance sheet and profit and loss accounts Records of wages and salaries Records of fixed assets Inventory records and statements (including quantities and values) and the end of any tax period, and all records of stock-counts related to inventory statements The FTA may require any other information in order to confirm through an audit trail the person’s tax obligation including any liability to register for tax purposes |

What are The Audit Procedures?

It is likely the FTA will conduct an audit in the following manner. At each stage, the penalty assessments increase for any disclosures affecting underpaid taxes or non-compliance.

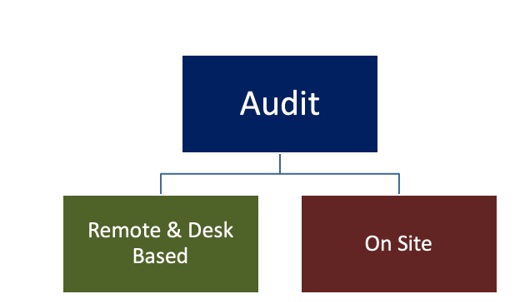

Initially, the emphasis may be on remote, desk-based audits where system data and documentation provided is the primary assessment model. If this is considered unsatisfactory, an onsite audit may occur which will require further preparation.

Requirement |

Impact |

|

|

Notice of Audit |

Respond within specified time to FTA 5 days’ notice of onsite audit |

Voluntary disclosure penalty increases to 30% |

|

Remote Audit |

Provide ledger data and documents which may include Invoices/credit notes Accounts UAE VAT return calculations System generated FTA Audit File or equivalent |

Follow up questions to be responded to in specified timescale Penalty for voluntary disclosure submitted increases to 50% |

|

On Site Audit |

The FTA will expect full cooperation to facilitate and assist the audit and would inspect documents, assets and premises | They can enforce removal of documents and asset if required and require open access to people to interview |

How Should You Prepare?

It is incumbent on the UAE business to demonstrate compliance under audit. Nothing should be presumed, and comprehensive preparation is the key.

Under a UAE Tax Audit the FTA will seek to establish:

- Summary understanding of your business and how it operates

- The accuracy of recording and rating your sales & purchase transactions

- How do you manage your sector risks e.g. customs processes, cash risks

- Management of your supply chain and the completeness of data

- Governance, process, and controls implemented across your business

Ensuring comprehensive documentation furnished on time is advised to demonstrate sufficient controls are implemented to internal processes, systems, and personnel.

Ideally, you should test your test returns for accuracy and target areas that are easy wins under an audit. Some easy wins include:

Over recovery for VAT on purchases including blocked input claims

- Tax invoice & credit note formats

- Inaccurately accounting for foreign exchange

- Reverse charge and imports

- Deemed supplies

- Transitional supplies spanning 2017 and 2018

- Accounting reconciliations and system compliance

If you believe these errors have occurred, correcting them before any audit under voluntary disclosure will be more economical than finding out under audit. The law grants reduced penalties under self-disclosure of errors the sooner they are declared.

What Could Result From A Tax Audit?

An audit could lead to several outcomes that range from:

- Assessment and penalties for non-compliance and underpaid taxes

- The further thorough process if additional issues are identified

If you prepare well and undertake a thorough review of your returns, your ability to manage a Tax Audit will be greatly enhanced.

Read Our Updated Blog UAE FTA VAT Audits Clicke Here

Accounting & Tax Services

As an approved FTA Tax Agency, SimplySolved supports businesses under advisory or complete outsource basis to optimise, manage and discharge tax obligation in the UAE. Our experts possess in-depth knowledge of the UAE tax regulations and can guide you through the intricacies of the UAE Corporate Tax Law.

By leveraging our expertise, you can streamline the process, saving time and minimizing the risk of errors. This proactive approach ensures that your Tax matter are handled efficiently, allowing you to focus on your core business activities.

Simply Solved is an ISO 9001 & 27001 certified company and a registered FTA Tax Agency. Our team of experienced consultants and tax agents provides high-quality, cost-effective services for all Tax matters for companies of all sizes.

About SimplySolved

At SimplySolved, we save your time, resources, and costs. Whether you need help with Outsourced Accounting, Finance, Tax, Employee Management & Payroll or ERP & Zoho Implementation. we have the expertise and solutions to help.

Subscribe to mailing list

Partner With SimplySolved

Serving over 300+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM & Payroll & ERP solutions. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the legislation and help you make better business decisions.

Copyright © 2024 | SimplySolved | All Rights Reserved.